Tokenization is paving the way for the creation of entirely new financial markets and instruments. As businesses move online and the versatility of digital transactions increases, tokenization is becoming the norm for transactions involving sensitive account details. This trend is driven by the rising number of data breaches and the growing demand for secure payment systems, which is anticipated to exhibit a CAGR of 18.8% from 2024 to 2032. Industries subject to financial, data security, regulatory, or privacy compliance standards are increasingly seeking tokenization solutions to minimize the distribution of sensitive data, reduce the risk of exposure, improve security posture, and alleviate compliance obligations.

Understanding How Tokenization Works

Tokenization is more than just a security measure; it’s a process that transforms sensitive data into a unique identifier, or token which by itself holds no useful information. Here’s a look at how tokenization works in a typical transaction.

Types of Tokenization

- Device Tokenization

- Card on File Tokenization

The Device Tokenization Process

Card Provisioning: HCE requests the device PAN from the CMS and provisions the card on the consumer’s device after receiving the tokens.

Transaction Management: For any transaction at the POS, the request is routed through the bank’s switch. The bank authenticates the request by validating the token and authorizes the payment.

Device Credentials Management: The bank manages device credentials for consumers, handling de-provisioning and deprovisioning if the consumer changes their mobile handset.

Token Lifecycle Management: The bank oversees the entire lifecycle of payment tokens for all contactless payments made with the app.

The Card on File Tokenization Process(for On-Us Tokenization)

Initiation: The process begins on the merchant platform where the customer selects the option to tokenize their payment details and submits the request.

Routing the Tokenization Request:

Direct Integration with Bank Gateway: If the merchant is directly integrated with the bank gateway, the tokenization request is sent directly to the bank.

Integration with a Third-Party Payment Gateway: If the merchant uses a third-party payment gateway or aggregator, the request first goes to the respective payment gateway, which then routes it to the bank gateway for tokenization.

Two-Factor Authentication: Upon receiving the tokenization request, the bank gateway initiates a two-factor authentication (2FA) process. This step is managed by the issuing bank’s Access Control Server (ACS) system. The customer must provide necessary authentication to proceed, after which the ACS confirms the authentication status to the issuing bank’s payment gateway.

Card Authorization: Post-authentication, card authorization is performed by the bank-managed credit card or debit card host systems. These systems handle the authorization outside of the issuer’s platform. Once the authorization is completed, the host system confirms the authorization status to the issuing bank’s TSP.

Token Generation: Following successful authentication and authorization, a new token for the customer’s card is generated. This token is stored in the issuing bank’s Token Vault System managed by iServeU . The Card Tokenization API is used to add the card to the token vault.

iServeU: Your Tokenization Powerhouse

iServeU, certified with EMVCo, PCI DSS, and major card schemes , offers a simplified solution spanning the issuance side of the payment ecosystem with tokenization solutions. As an early adopter of the 3DS 2.0 certification, iServeU provides a full spectrum of Token Service Provider and Authentication services for financial companies. It also offers Token Vault solutions, including Issuer Tokens, with end-to-end token lifecycle management and value-added services (VAS) built on the latest technologies and global standards.

Key Features

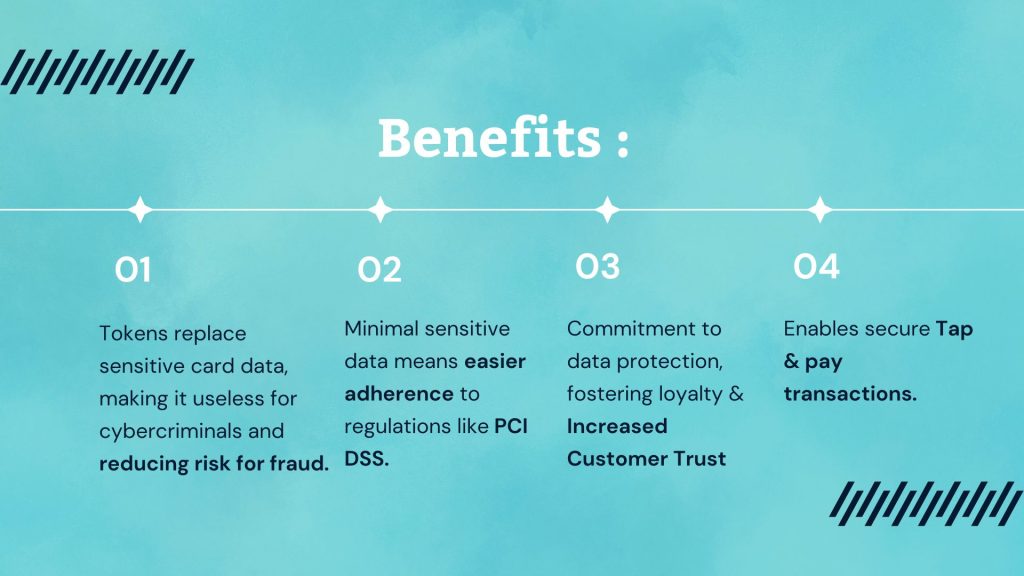

Issuers benefit from tokenization in several ways:

Conclusion:

Tokenization is transforming how transactions are conducted and securing sensitive data across various industries. As data breaches become more frequent and the demand for secure payment systems rises, tokenization offers a robust solution that enhances security, simplifies compliance, and fosters trust among customers. With iServeU’s comprehensive tokenization solutions, businesses can seamlessly integrate this powerful technology into their payment processes, ensuring a secure, efficient, and innovative transaction environment. Embrace the future of financial security and innovation with tokenization today.

Testing for spam comment