Fraud Risk Management system

Our advanced FRM solution is designed to safeguard your business against fraudulent activities. With its preventive and detective modules, rules-based transaction checks, and self-learning ML models, it provides real-time detection of suspicious activities, keeping your banking operations secure. Its anti-money laundering capabilities and advanced features make it the ultimate solution for mitigating risks and protecting your business. Trust our FRM solution to be your first line of defense against fraud.

Modules

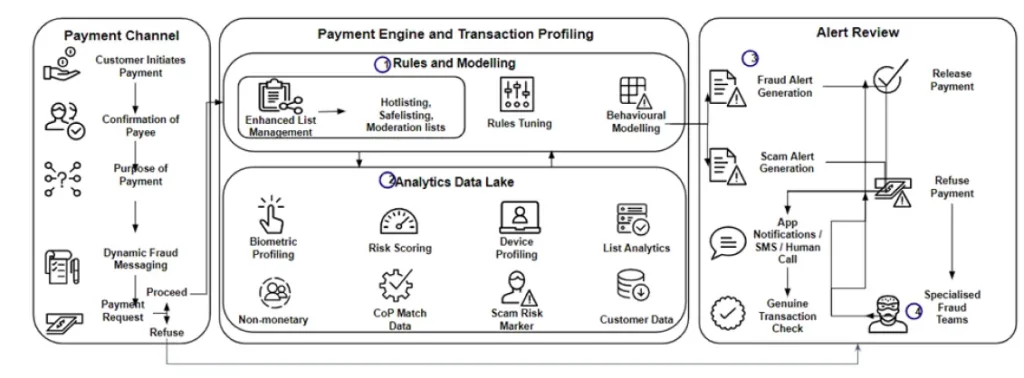

Preventive Module

A module within our FRM solution that offers a proactive approach to fraud prevention.

Detective Module

The module that provides real-time detection of suspicious activities

Key Features

Fraud Detection Systems

Transaction monitoring systems

Geolocation Monitoring

Compliance with Regulations

Anti-phising trainings

Auditing & reviewing platform

Customer education modules

User Authentication

Device Fingerprinting

Real-time Alerts

Benefits

Analyze transaction patterns, user behavior, and other parameters to identify anomalies

AI& Ml algorithms for detecting unusual patterns or deviations from normal behavior.

Set threshold limits for various transaction parameters- transaction amount, frequency, and location.

Analyzing user behavior for detecting fraudulent activities -Unusual login times, multiple failed login attempts, or sudden changes in transaction patterns

Discrepancy in geolocation & fingerprints could be flagged for review & red flagged respectively.

Prompt immediate investigation by the concerned authorities to prevent any potential fraud.

Continuous risk analysis is performed on transactions to assess their legitimacy.

Multi-factor authentication is a critical component of UPI transactions.

Comply with anti-money laundering (AML) and other financial regulations.