Every swipe of your credit card sets off a complex ballet of data exchange. At the core of this process lies a seemingly simple sequence of numbers: the Primary Account Number. While often overlooked, the PAN is a crucial component of the payment ecosystem, carrying vital information about the cardholder and the issuing bank. Primary Account Number (PAN) also known as Card Number is a unique identifier assigned to a credit or debit card. It’s the string of numbers you see on the front of your card, excluding any additional security features like CVV or expiration date. While it might seem like a random sequence, the PAN is carefully structured to convey specific information about the card and its holder.

Components of a PAN

A typical PAN consists of several elements:

- Issuer Identification Number (IIN) or Bank Identification Number (BIN):The first six to eight digits of the PAN identify the issuing bank or financial institution.

- Account Number:The following digits represent the cardholder’s specific account number within the issuing bank.

- Check Digit:The final digit is a calculated value used to validate the card number.

Bank Identification Number(BINs)

The BIN, the initial segment of the PAN, is a critical piece of information for various parties involved in payment transactions. It offers insights into the card’s type, as indicated by the first digit or Major Industry Identifier (MII), which categorizes the card’s issuing industry (e.g., credit, debit, prepaid card). Additionally, the subsequent digits within the BIN precisely identify the specific issuing bank or financial institution. Furthermore, the BIN can often provide clues about the cardholder’s geographic region.

How BINs Are Structured

BINs are assigned and managed by international organizations like ISO and IEC. They follow a specific structure:

- Major Industry Identifier (MII):The first digit identifies the card’s industry (e.g., banking, travel, oil).

- Issuer Identifier:The following digits specify the issuing bank or financial institution.

- Country Code (optional):In some cases, the BIN may include a country code.

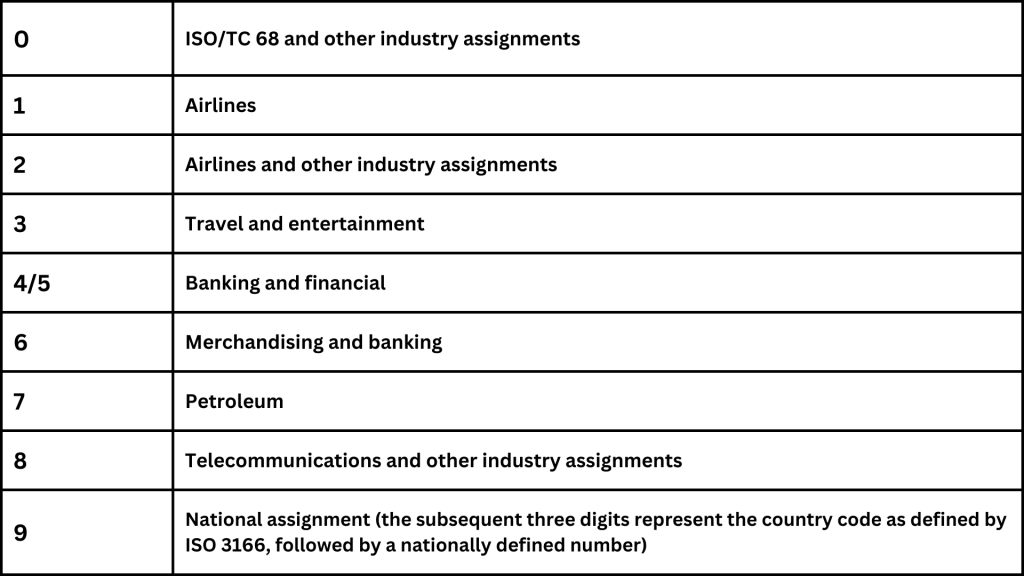

Major Industry Identifier (MII)

The first digit of a PAN, known as the Major Industry Identifier (MII), provides a crucial clue about the card’s origin. This single digit categorizes the card’s issuing industry, helping to shape the overall payment ecosystem.

For instance, credit and debit cards typically commence with a 3, 4, 5, or 6, as these numbers are designated for the banking and financial sectors. Airlines often utilize 1 or 2, while the oil industry is represented by 7.

Here's a breakdown of the MII codes:

It’s important to note that while the MII offers a general indication of the card’s industry, it doesn’t definitively pinpoint the specific issuer. The following digits within the BIN provide more granular information about the issuing bank or financial institution.

For example, Visa cards predominantly begin with a “4” as most Visa issuers are banks or financial institutions. However, it’s essential to remember that this is a general trend and not an absolute rule.

Check Digit

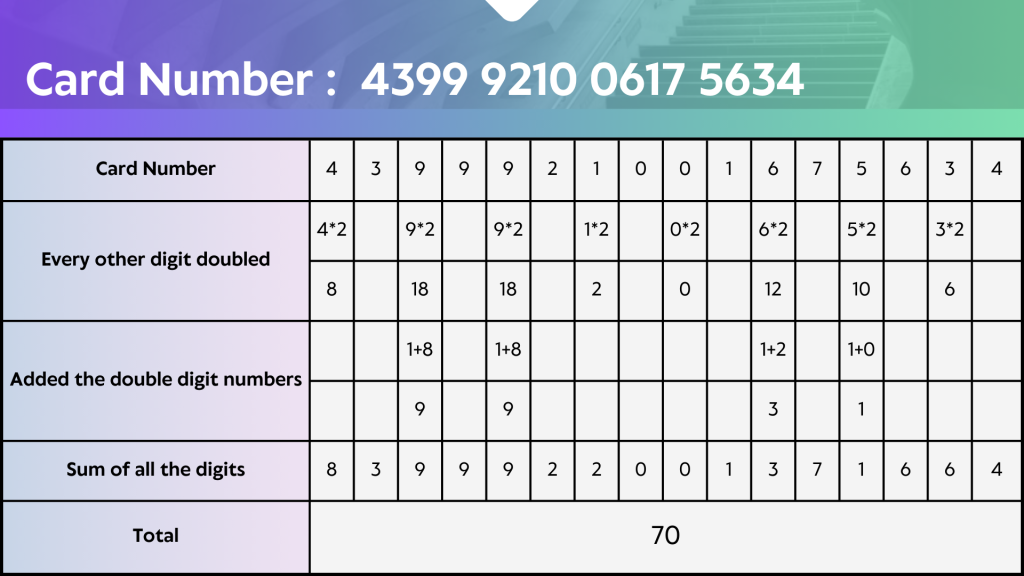

The final digit of a PAN is a crucial security feature known as the check digit. It’s calculated using the Luhn algorithm to verify the accuracy of the entire PAN number. This mathematical process helps prevent errors like typos or mistyped digits, enhancing the overall security of the card.

The Role of the Luhn Algorithm

To ensure the accuracy and validity of PANs, the Luhn algorithm is employed. This mathematical formula checks for errors in the card number. By performing a series of calculations on the digits, the algorithm determines whether the PAN is likely to be valid.

How the Luhn Algorithm Works:

- Double every other digit, starting from the rightmost digit.

- If the doubled value is greater than 9, add the digits together.

- Sum up all the digits.

- If the sum is divisible by 10, the PAN is likely valid; otherwise, it's invalid.

- The Security Implications of PANs.

PANs are sensitive data that require robust protection. Data breaches and unauthorized access to PANs can lead to severe financial consequences for both cardholders and businesses

Future of PANs

As technology continues to evolve, so too does the payment landscape. Emerging technologies like tokenization and biometric authentication are transforming how PANs are handled. While the core concept of the PAN is likely to remain, its implementation and security measures will undoubtedly adapt to meet the challenges of the future.

Conclusion

The intricacies of PANs and BINs is essential for businesses operating in the payment industry. By grasping the structure, components, and security implications of these elements, organizations can enhance their payment processes, mitigate risks, and improve customer experience. As the payment landscape evolves, staying informed about the latest trends and best practices will be crucial for staying ahead of the curve.