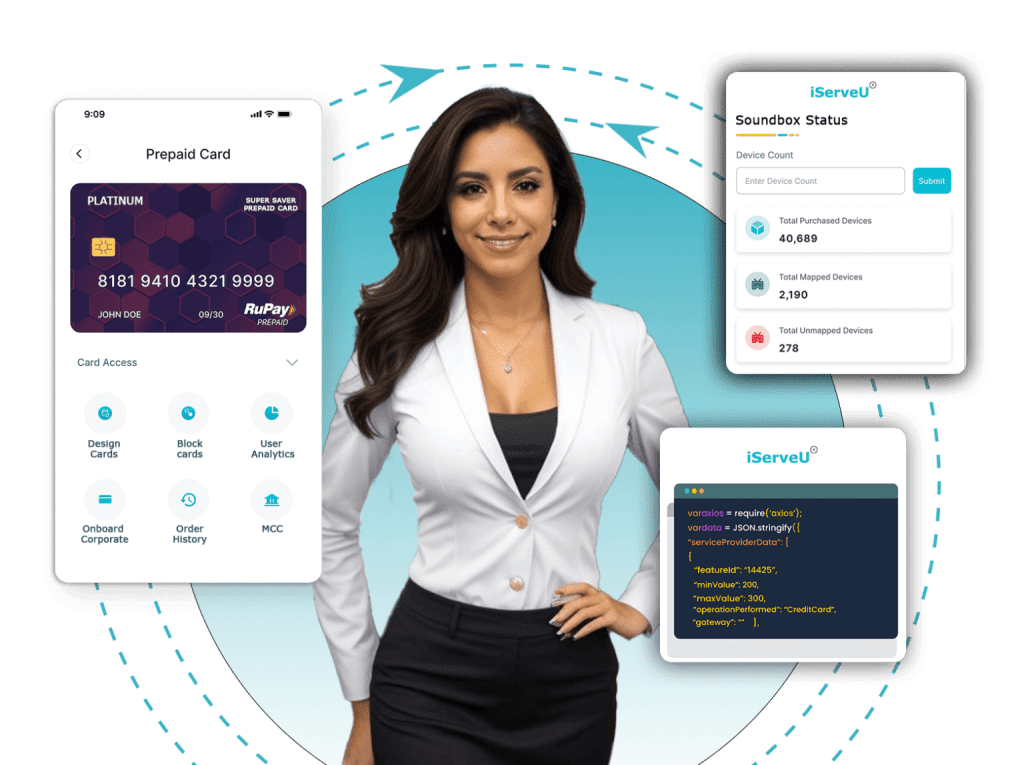

Financial that elevates Customer Experience

We deliver award winning banking infrastructure to Banks, Fintechs, NBFCs and other businesses across globe along with high transaction processing proficiencies.

Clientele

0 +

Transactions per Second

0 +

Presence in countries

0 +