India’s ATM infrastructure is experiencing a structural shift. Monthly ATM withdrawal volumes have declined from 57 crore transactions in January 2023 to 52.72 crore in January 2024, reaching 48.83 crore by January 2025—a 14.3% drop in 24 months. This showcases a fundamental reallocation of how consumers access physical currency.

Meanwhile, UPI transactions in January, 2025 surpassed 16.99 billion and the value exceeded ₹23.48 lakh crore cementing its position as the primary payment rail for retail transactions.

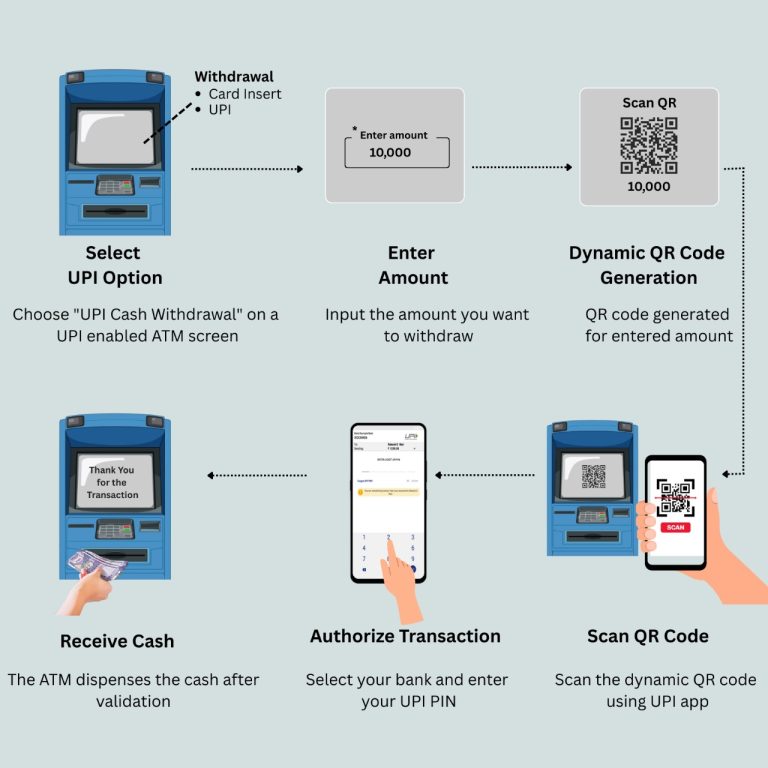

UPI’s ecosystem has evolved to integrate with PPIs, credit-on-UPI facilities—yet cash access remained card-dependent in a 90%+ smartphone-banked economy. UPI-based cardless withdrawal (ICCW) emerged as the systemic answer—enabling any UPI user to withdraw cash from participating ATMs by scanning a dynamically generated QR code, authenticated via UPI PIN. No card. No issuer restrictions. Pure account-based access.

Understanding UPI Cardless Cash Withdrawal

Interoperable Cardless Cash Withdrawal (ICCW) commonly known as UPI-ATM cash withdrawal enables cash withdrawal through UPI. A dynamic QR code is generated at the ATM terminal, which users scan via any NPCI-approved UPI application. Transaction authentication occurs through the existing UPI PIN infrastructure, eliminating the need for card-based verification protocols. iServeU’s UPI ATM solution enables seamless UPI-based cash withdrawals across networks.

How UPI ATM Works

This service is interoperable, allowing customers to use their UPI apps across ATMs of different participating banks, enhancing convenience.

- Growing Importance of UPI Cash Withdrawal

- UPI cash withdrawal eliminates the need for physical cards, removing exposure to card loss, theft, or skimming fraud at ATMs also eliminates dependency on major card networks

- The service operates through dynamic QR codes paired with device binding and UPI PIN verification, providing stronger authentication compared to magnetic stripe or chip-based card transactions.

- A single UPI app supports withdrawals from multiple linked bank accounts, simplifying multi-bank management, reducing the dependency on debit cards.

Debit card transactions dropped from 495.32 crore in 2019 to 173.90 crore in 2024.

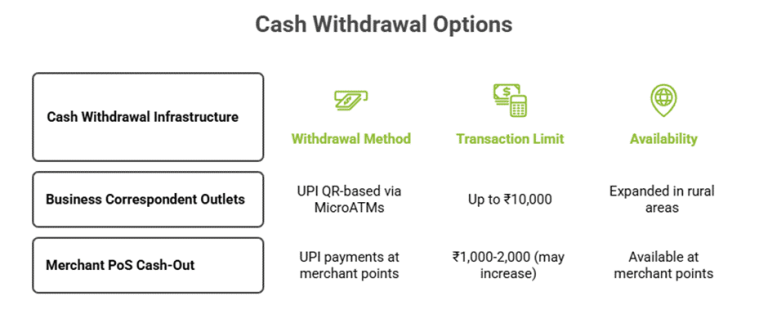

- NPCI’s rollout across 2 million+ Business Correspondent outlets targets rural and semi-urban regions, placing cash access points closer to populations with limited banking infrastructure.

- UPI withdrawals bypass the ₹23 interchange fee charged on card-based ATM transactions beyond free limits, reducing transaction costs for regular users.

- Expansion Beyond ATMs

Rural ATM numbers decreased by 2.2%, reflecting strategic bank rationalization in favour of digital channels. Furthermore, showcasing the extension of UPI cash withdrawal infrastructure to additional channels like Business Correspondent (BC) Outlets and Merchant POS Cash Out.

- Challenges Ahead & The Road to Scalable Adoption

ICCW implementation exposed operational challenges for White Label ATM Operators managing 25% of India’s ATM network—legacy infrastructure incompatible with UPI rails, complex multi-provider coordination, and reconciliation overhead.

- Backend Infrastructure Load: Managing nearly 20 billion monthly UPI transactions requires continuous upgrades to maintain transaction speed and reliability.

- Cash Logistics: Efficient cash replenishment at a vast dispersed BC and merchant network poses logistical hurdles.

- User Trust & Awareness: Extensive user education is essential to mitigate concerns over scams and fraud and to increase adoption.

- Merchant & BC Incentives: Sustainable revenue models are needed given the zero-MDR (Merchant Discount Rate) policy on most UPI transactions.

Despite these barriers, the outlook for UPI cash withdrawals remains strong. With growing ecosystem participation, improved ATM–UPI integration, and regulatory support from NPCI and RBI, the foundation for large-scale interoperability is already in place.

Conclusion

UPI-based cash withdrawal marks a significant shift in India’s payment infrastructure. With over 500 million active users and expanding coverage through ATMs, BC outlets, and merchant points, the service addresses security and accessibility limitations of card-based systems. As NPCI scales deployment across 2 million+ BC outlets, UPI cash withdrawal is positioned to become a primary channel for cash access—particularly in underserved regions—supporting India’s digital-first financial ecosystem while maintaining practical cash availability.

iServeU’s BaaS platform enables White Label ATM Operators to deploy ICCW solution pre-integrated NPCI connectivity. Connect with us to integrate UPI ATM solution into your infrastructure.

Author

Rakesh Das, Program Manager

I have hands-on experience in B2B and FMCG sales, along with digital marketing, working closely with clients to drive measurable growth. My time at iServeU has deepened my passion for fintech and backend payment systems, while collaborating with CXOs has strengthened my understanding of both business and technology. Outside work, I’m enthusiastic about powerlifting, kickboxing, and exploring new cultures through travel.