India, despite its rapid economic growth and technological advancements, remains a deeply underserved market when it comes to credit access. A significant gap exists in providing credit to a vast segment of the population, leaving many without adequate financial support. This is where the introduction of Credit lines on UPI comes into play, potentially revolutionizing the banking sector, particularly for small finance banks (SFBs) and traditional banks.

The Current Credit Landscape

Today, consumers have a plethora of financial tools at their disposal for borrowing money—personal loans, pay-later apps, credit cards, payday loans and more. Among these, credit cards and credit lines are the most preferred. However, despite their popularity, these tools have not been able to bridge the significant gap in credit access for many underserved segments of the Indian population.

UPI: A Retail Phenomenon

UPI has emerged as one of the most deeply penetrated payment channels globally. Dominated by major platforms like PhonePe, Google Pay and Paytm, none of which are traditional banks, UPI has transformed the way retail transactions are conducted in India. Its success is a testament to the power of digital payments.

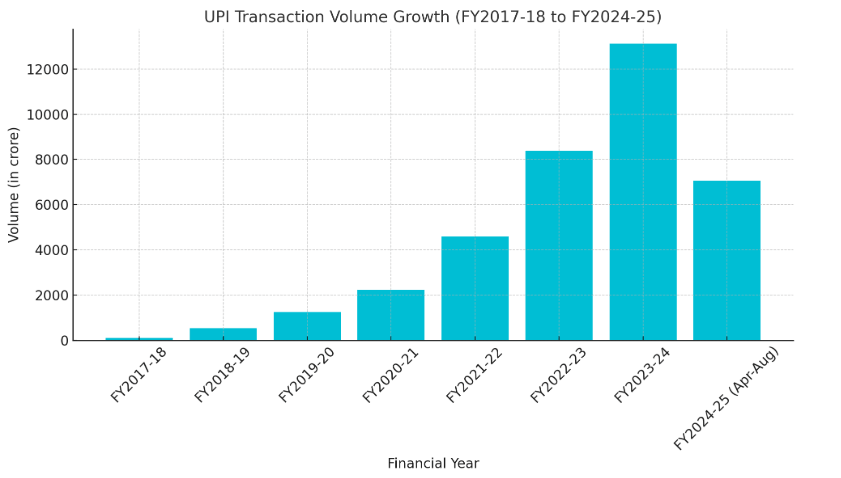

Here is the bar graph showcasing the exponential growth in UPI transaction volumes from FY 2017-18 to FY 2024-25 (April-August). The data highlights a phenomenal CAGR of 129% over the years, reflecting the success of digital payment adoption in India.

With the latest directive from the Reserve Bank of India (RBI) allowing Small Finance Banks (SFBs) to offer credit lines on UPI, modern-day banking and credit accessibility is dawning. This move holds immense potential for extending credit to underserved segments and unlocking new revenue streams for banks.

Credit Line on UPI: Not Rocket Science

The concept of credit lines on UPI is refreshingly simple. If a user holds a credit account, they can access it via the UPI platform, be it their bank’s app or any other UPI-enabled app. This simplicity, paired with UPI’s widespread adoption, turns it into a powerful tool for credit access. This feature allows customers to tap into pre-approved borrowing limits effortlessly. By integrating their credit lines with UPI accounts, users can streamline their financial management, cutting down on the need for multiple credit cards and fully digitizing the process. Scanning a QR code and choosing the credit line source mirrors the familiar steps users take with their savings accounts, making the experience seamless and intuitive.

The Ramifications for Banks and SFBs

- Leveling the Playing Field: The credit lines on UPI will level the playing field for banks and SFBs, allowing them to compete more effectively with non-bank payment platforms. Banks have the natural advantage of a pre-approved customer base (CASA accounts), which can be leveraged to extend credit more efficiently.

- Strategic Dominance: To establish dominance in the UPI space, banks need to integrate the right modules and features. This is a second coming for UPI, and banks must be prepared with the necessary tech components and critical success factors. They must have a robust Loan Management System (LMS), core banking software and Credit Card Management Systems (CCMS) to manage credit products efficiently.

- Digital Transformation: SFBs aiming to distribute credit products on UPI need a comprehensive digital platform. This includes digital origination, customer lifecycle management, digital collections and digital rewards. Such an integrated approach will ensure seamless operations and customer satisfaction.

The ease that credit lines on UPI bring to the processes of discovery and utilization cannot be overstated. Especially in tier-2 and tier-3 cities, where credit demand is growing rapidly, this system will significantly enhance credit utilization. Retail lending is already growing at about 12-13% year on year and with credit lines on UPI, we can expect even higher utilization rates.

iServeU's Role in Enhancing CLOU

iServeU stands as the ultimate solution for integrating credit line functionality with UPI through our comprehensive unified credit stack. Our platform equips financial institutions with versatile lending solutions across diverse channels, ensuring broad customer accessibility. By facilitating seamless credit distribution, our platform promotes higher credit utilization and supports multiple credit lines for various brands and partners. Engineered for speed, scalability and customization, this tech stack sets the benchmark for credit operations.

- Creditline Management:

iServeU platform offers flexible lending solutions across various channels, providing risk intelligence to lenders to improve their collection percentage and approval rates. Compliant with the regulator’s guidelines on digital lending, it allows pre-sanctioned credit on UPI, enhancing accessibility and convenience for users. - Underwriting:

Integrating the credit scoring and decision engine with various data sources, iServeU ensures the system can handle large volumes of data efficiently, enabling accurate credit assessments. By leveraging diverse data points, including transaction histories and credit scores, our solution enhances the precision of credit underwriting, reducing risk for lenders and improving credit accessibility for consumers. - UPI Interface:

The UPI Interface stack seamlessly integrates with our credit line functionalities, allowing users to access and utilize their credit lines effortlessly. This integration ensures real-time credit availability and usage across UPI platforms, enhancing user experience and operational efficiency. - UPI Switch:

The UPI Switching solution acts as a middleware layer, seamlessly connecting various banks and payment services. It efficiently routes transaction requests to the appropriate channels, ensuring smooth and secure transfers from senders to recipients. The solution links banks to the UPI network managed by NPCI, facilitating uninterrupted digital payments. - Loan Origination System (LOS):

iServeU’s loan origination subsystem supports advanced credit decision modeling, a customizable calculation tool, and features like bulk disbursal and quick loan sanction timing, significantly reducing turnaround time. The subsystem is cost-effective, requiring minimal maintenance, and its robust capabilities extend to delinquency management, loan modification and restructuring, payoff, and loan termination processes. Additionally, it generates inbuilt reports, providing actionable insights and ensuring seamless operations. - Business Rule Engine (BRE):

The BRE offers the benefits of automation, such as speed, accuracy, cost reduction and heightened performance. It ensures that business rules are consistently applied, streamlining processes and enhancing decision-making. - Loan Management System (LMS):

iServeU’s LMS automates accruals and reconciliations, streamlines end-to-end digital lending processes for Banks, NBFCs, and MFIs. The LMS covers critical functionalities, including credit verification, thorough underwriting, prompt sanctioning, and comprehensive portfolio monitoring. Its features extend to efficient loan servicing, seamless payment processing, and meticulous account maintenance, ensuring operational excellence at every stage. Additionally, the platform effectively manages delinquency, supports loan modification and restructuring, and simplifies payoff and loan termination processes. With its ability to generate inbuilt reports, iServeU’s LMS make data-driven decisions, optimize loan portfolios, and enhance customer satisfaction. - No-Code Integrations:

iServeU platform supports no-code integrations, enabling financial institutions to quickly integrate and deploy the solutions without extensive coding efforts. This accelerates time-to-market and reduces implementation costs.

How the Model Works

- Integration with SFBs: iServeU collaborates with SFBs to offer credit products, integrating through APIs and SDKs for real-time credit availability on UPI platforms. This partnership enhances the reach and accessibility of credit.

- User Eligibility and Onboarding: Users undergo a credit assessment based on their transaction history and credit score, receiving instant credit approval. This streamlined process ensures quick access to credit.

- Credit Disbursement: Approved credit amounts are linked to the user’s UPI ID, facilitating seamless credit utilization.

- Transaction Process: Users can scan QR codes or use peer-to-peer transfers to make payments using their credit line.

- Repayment: Flexible repayment options, such as EMIs or lump-sum payments and auto-debit arrangements ensure timely repayments.

- Security and Compliance: UPI’s secure infrastructure protects all credit transactions, adhering to RBI guidelines, and ensuring safe and regulated credit activities.

Conclusion

The introduction of credit lines on UPI is poised to be a gamechanger for banks and small finance banks in India. By leveraging this innovative credit platform, SFBs can bridge the significant gap in credit access, enhance their competitive edge, and contribute to a more inclusive financial ecosystem. The potential for growth, especially in underserved segments, is immense, making this a pivotal moment in India’s financial journey.

This blog explains how the credit line on UPI will revolutionize small finance banks, enhancing accessibility and financial inclusion. A must-read for those interested in the future of digital banking!

Insightful and timely post! A clear, engaging exploration of how UPI credit lines empower small finance banks and drive financial inclusion. Extremely valuable read.