BNPL (Buy Now Pay Later) isn’t a new concept; it has been around for a while, allowing consumers to split their payments into manageable installments. However, the surge in e-commerce and the growing demand for user-friendly payment options have catapulted BNPL into the spotlight, making it one of the most choiced & fastest-growing segments in the payments industry. This trend reflects a shift in consumer behavior, driven by the desire for financial flexibility without the burden of high-interest credit products.

BNPL: A New-age Lending Solution

BNPL has evolved into a powerful lending tool that not only benefits lenders & merchants but also offers significant advantages to consumers. The software enables individuals to make high-value purchases without immediate full payment, breaking down the cost into smaller, more manageable installments. This method has become particularly appealing to consumers who are wary of traditional credit options, such as credit cards, due to their complex terms, potential for accumulating interest & CIBIL score restrictions.

For e-commerce merchants, BNPL solutions like those offered by iServeU have become indispensable. They help increase conversion rates, boost average order values, and expand the customer base. Merchants receive the full payment upfront (minus a small fee), while the lender takes on the responsibility of managing the loan, including underwriting customers, collecting payments, and handling any defaults through the BNPL platform. This allows merchants to focus on growing their business without worrying about the intricacies of credit management.

How iServeU BNPL Solution Connects Lenders with Merchants

iServeU’s BNPL solution acts as a crucial middleware that connects lenders with merchants, streamlining the entire transaction process. Here’s how it works:

Merchants can easily e-contract and integrate the platform with their existing systems. This enables lenders to present their BNPL options in a way that aligns with each merchant’s business strategy. When a customer selects BNPL, the platform performs a quick, internal credit check (soft check) to determine eligibility and then assigns a credit limit. This provides a smooth shopping experience and helps lenders approve qualified applicants. Once approved, the merchant processes the transaction. The consumers process the transaction without paying any amount, or else the lender can avail installment options for consumers. iServeU offers lenders full control over establishing and managing interest rates and charges. The platform is configurable, accommodating different business models and customer needs. This includes options for varying repayment schedules, merchant fees, and acceptance of multiple payment types.

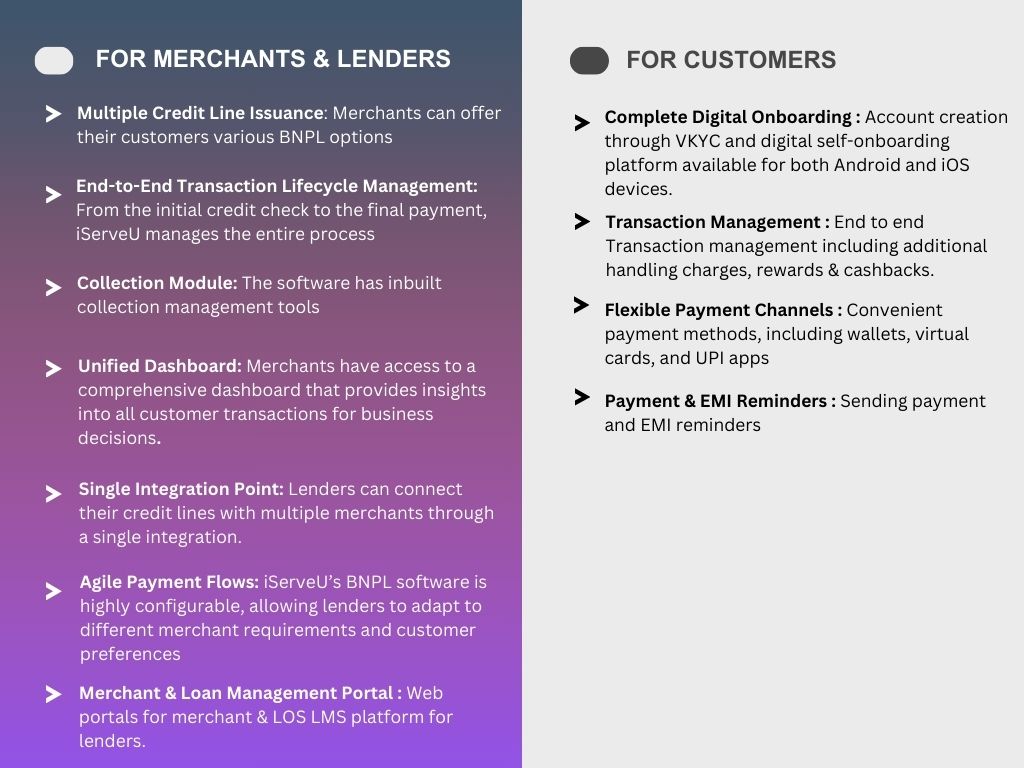

iServeU’s BNPL platform is designed with features that cater to both lenders and merchants, ensuring a smooth and efficient transaction process:

Benefits of BNPL for Merchants & Lenders

The advantages of BNPL extend beyond convenience, offering significant benefits to all parties involved:

- Increased Sales and Customer Loyalty:Offering BNPL options encourages customers to make larger purchases and return to the store for future needs.

- Easy Implementation:With the use of Open APIs and other platforms, integrating BNPL into existing online stores is straightforward and requires minimal technical adjustments.

- Enhanced Consumer Insights:BNPL platforms provide merchants with valuable data on consumer behavior, helping them refine their marketing strategies and improve cross-selling efforts.

- Cost-Effective Customer Acquisition:BNPL at merchant checkout offers a low-cost acquisition channel, allowing lenders to reach new customers and cross-sell additional products.

- Low Operational Overheads:The streamlined nature of BNPL software reduces the administrative and operational burden on lenders, making it a cost-effective solution.

Customer Benefits: Flexible and Accessible Financing

For customers, iServeU’s BNPL platform offers a range of benefits that make it an attractive alternative to traditional credit options:

- Flexible Payment OptionsLenders & Merchants can avail high-ticket purchases and installment payment options for consumers, making it easier to manage their finances.

- Instant Credit Access:Customers can access multiple credit lines and EMI options of lenders instantly, providing them with the flexibility they need to make purchases.

- Cardless EMIs:Lenders can offer credit card-less EMI facilities for their consumers without stressing about CIBIL score.

The Future of BNPL in Global Arena: A Growing Market

As India’s economy continues to evolve, the BNPL market is poised for significant growth. The increasing popularity of e-commerce, coupled with changing consumer preferences, is driving the demand for flexible payment options. Younger generations, in particular, are gravitating towards BNPL as an alternative to traditional credit cards, which are often seen as cumbersome and expensive.

The future of BNPL globally looks promising, with more merchants, lenders, and consumers embracing this innovative payment solution. As digital financing options continue to expand, BNPL is set to play a crucial role in shaping the country’s financial landscape, offering a more inclusive and accessible way for people to manage their finances.

Conclusion: Embracing the BNPL Revolution with iServeU

iServeU’s BNPL platform is at the forefront of this lending solution, providing a seamless connection between lenders and merchants while offering customers the flexibility they need. By integrating BNPL into their payment systems, businesses can not only enhance their customer experience but also drive growth and expand their market reach.

For lenders, iServeU offers a cost-effective and efficient way to reach new customers and increase the utilization of existing credit lines. And for customers, BNPL represents a new era of financial flexibility, making it easier than ever to make purchases without the burden of high-interest credit products.

As India’s BNPL market continues to grow, iServeU is poised to lead the way, helping businesses and consumers alike navigate this exciting new frontier in financial services.